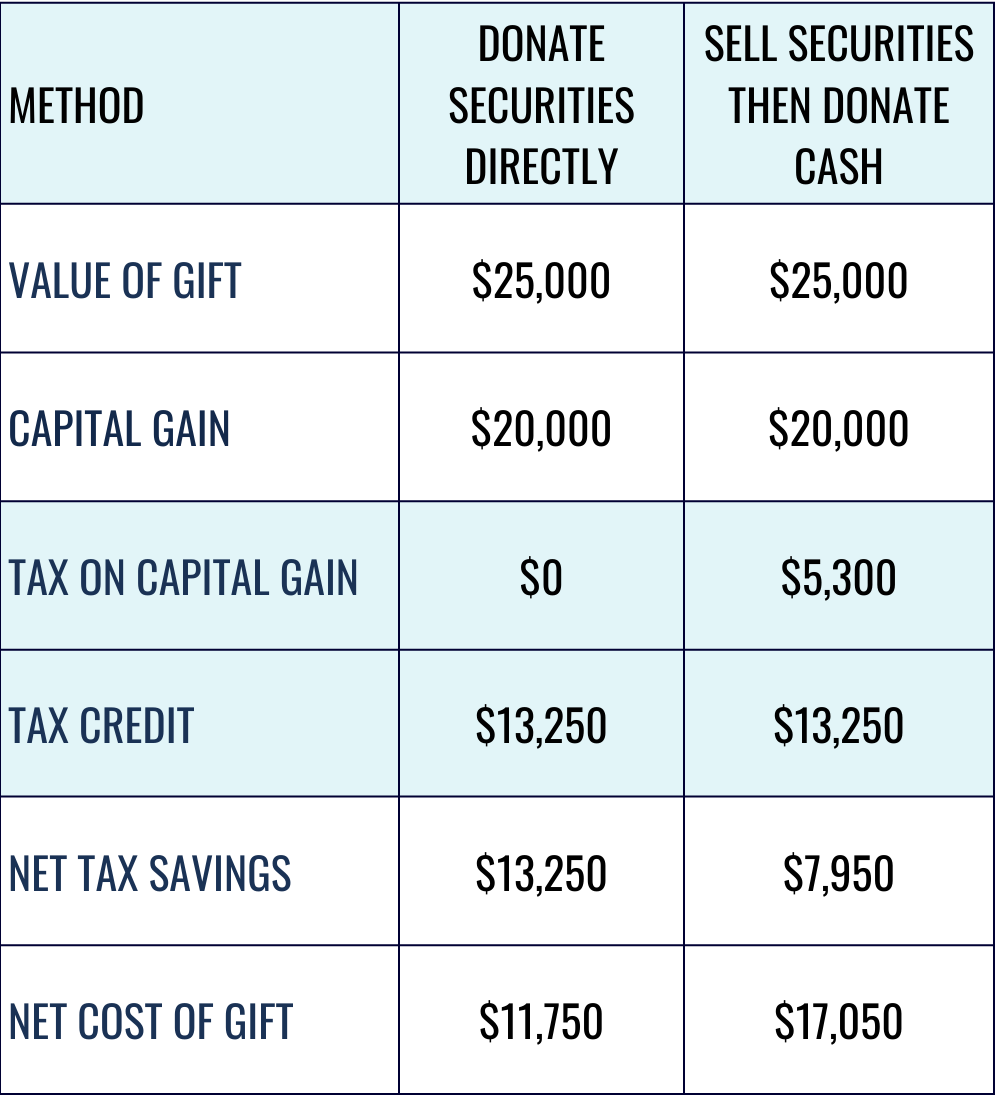

Donating publicly-traded securities is a tax-smart way to support St. Joe’s.

Donating publicly-traded securities is one of the most efficient and tax-effective ways to support St. Joe’s. By giving shares, mutual funds, or bonds directly, you can make a meaningful difference in patient care while maximizing your charitable impact.

Want to learn more about giving gifts of securities

Donating gifts of securities is simple

Securities can include stocks, mutual funds, segregated funds, bonds, flow-through shares, and employee stock options. You can give now, or as part of your estate and will planning. Consult your financial advisor to decide which investments make the most financial and philanthropic impact. Then ask your broker to transfer your securities to St. Joseph’s Health Centre Foundation.

Please note: Transfers should be initiated before December 15 to be guaranteed a tax receipt for that year. We will do our best to accommodate all transfers when they arrive.

Your gift of securities helps us deliver compassionate, innovative care to our community — today and for generations to come. It’s not just giving back; it’s looking forward.

Want to learn more about giving gifts of securities, contact our team.